My name is Peter Westbrook with Westbrook Real Estate Investments and I have been a real estate investor for close to 10 years. With over one hundred completed transactions under my belt I have found that no matter what side of the table I am on, Buyer or Seller, the struggle over a Sacramento homes value is the primary hurdle that both the buyer and seller need to overcome and ultimately agree upon.

What is My House Worth in Sacramento? It Really Does Depend on Who You Ask!

Sometimes I am convinced that the system of valuation is rigged by the establishment players especially when we realize that it is commission based and higher valuations equal higher commissions. It is ok when buyer and seller agree, but when there is a disagreement over valuation even the most simple transactions can become difficult.

Prior to the bursting real estate bubble of 2008, valuations were the exclusive territory of real estate agents and appraisers in what appeared to be a collusion in determining valuations in the Sacramento real estate market. At one point prices were rising so rapidly that valuations and appraisals that were one week old were no longer valid.

In 2016 the rules have changed and now we have access to many more sources of data to determine the value of any house in Sacramento. Until 6 years ago, the real estate agents Multiple Listing Services (MLS) Comparative Market Analysis (CMA) and an Appraisal were exclusive and gospel. Even Certified Appraisers fell in line with a well positioned CMA or face severe criticism.

In this article I want to explore the different valuation methods that have been used for years by real estate agents and compare that methodology to the more advanced valuation methods of recent years with the addition of multiple sources of new data.

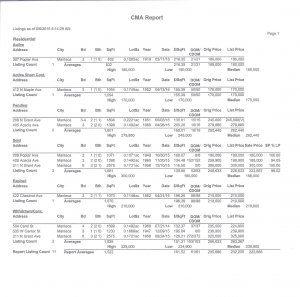

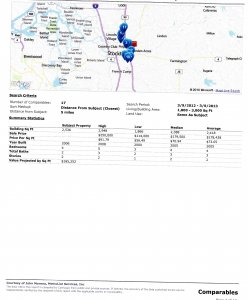

If I asked a real estate agent “what’s my house worth in Sacramento” I am sure that I would get pretty much the same answer based on a report called a comparative market analysis. The CMA is a report that is exclusively based on the multiple listing service (MLS) data base for houses sold by agents in a specific geographic region, over a specific period of time. I accept that… we all need to start somewhere but the MLS database is no longer the holy grail of real estate transactions because it is lacking sales information regarding houses that sold for cash and did not involve a real estate agent.

Yesterday I received a phone call from a real estate agent, I’ll call her Sally. She told me that she was talking to her sister’s best friend about an offer that I had made on a house (located at ABC Street in Sacramento Ca) and that she wanted to discuss the offer with me.

It all sounded reasonable enough, so I responded, with my usual… “How can I help you?

She continued; that she had run a Comparative Market Analysis (CMA) for the house and that her research showed that the house was worth considerably more than what I was offering and wanted to know why my offer was so low?

I remembered the house and the owner, so I asked her; “Have you seen the house in question?”

She replied that she had and that it needed some cosmetic work inside and out”.

I was a little surprised by the answer, so I asked her to verify the address because I may have looked at a different house or made a mistake.

She verified the address and I calmly explained that the collapsing front porch was not cosmetic and that it was symptomatic of the entire roof collapsing because it had not had any maintenance since the tree had fallen on it 12 years ago”. I also explained that there severe siding issues, dry rot issues around most of the single pained windows and doors, settling issues and cracks in foundation and the plaster had cracked throughout the interior of the house. Not to mention the mold in the bathroom and dry rot under the bathtub and toilet.”

I asked; “Can we really compare this distressed house to what you found through your MLS, in the CMA?” ”Did you request any Title Company cash sales comparisons as well?”

Her response was textbook… she replied,” I searched for properties sold and listed in MLS for the past 90 days within a quarter mile of the house and this was the high, median, and low”. She continued, “I have been in the real estate business for 3 years and I know how to run a CMA and I am really concerned, it sounds like you are trying to steal the house”.

I responded in kind; “that would be hard to do, but that aside, I understand that you think that an MLS, CMA is complete, but what we are comparing here are apples and oranges, because had you requested comparable data from the title companies as well you would have found the many houses that were not sold by real estate agents and were ever not listed on the MLS. You would have found the cash only purchases as well and they tell a completely different story and indicate a wide range of market values and comparisons. Especially for a house in similar condition.

She insisted that it didn’t matter and that the MLS data was the most accurate and that the Title Company data was irrelevant.

I responded; “Sally, I understand your concern, but this may be a good exercise for both of us. Maybe we both can learn something and we can help your sister’s friend at the same time.” Do you realize that the MLS data is isolated to properties that are only sold by real estate agents?”

She insisted I was wrong. I then asked if she was aware that the data provided by MLS did not include all cash only transactions and/or any concessions offered by the buyer to the seller that in fact lowers the overall cost but is not reflected on MLS?. Another point she immediately rejected.

So, I asked “if you are convinced that the property is worth considerably more than what I offered; “May I ask why you aren’t selling the house for her? If somewhere between the low, median and high is what you think that she can get, why don’t you just list it and sell it?”

Her response was priceless… “Peter, I could, but I don’t sell these types of houses and that house would never qualify for financing because of the repairs needed and the owner has already told me that she has no money to fix it up.” “I was just calling you to ask why your offer was so low?” she continued to tell me that she could sell it for what I offered.” And that she had heard about investors like me”.

Really like me? I kept that to myself.

So I said … “Sally, we both agree that the house cannot be sold conventionally with financing and I bet that you could eventually sell the house and if you did list it , but, could you with a straight face to do so and charge your sisters friend a sales Commission for a sale at the same price I am offering her minus your commission?”

Without hesitation she said, “of course I would, I get paid to do this.”

My response was simply… now who is taking advantage of whom?” Your sister’s friend can sell her house to most investors, without any fees and commissions and they’ll even pay the closing cost. Why should she sell it through you and pay a commission?” How are you going to add value without increasing the sales price in some way?

There was silence on the other end of the phone. Sally understood my point, but the real point is that in an industry so vast, with so many markets and niches, no two houses are the same and sometimes the CMA or any other analysis is just a guess. If it weren’t’, then there would be no reason for some houses to sell in one day and others that sit for a year. To further make the point, why do we see listed properties with reduced prices, why do we have expired listings and what graveyard do they end up in? The truth is that not all houses are created equal and the notion that Investors “steal houses” or buy them at discounts is complete NONSENSE.

The truth is that the real estate market is not one size fits all and yet the Real Estate Industry has convinced the public at large and its representatives that we can determine the value of house via the critical sales data found within the Multiple Listing Service Databases exclusively. That somehow, if we analyze the sales of properties over a certain period of time generally comprising the past 3 months, for a specific geographic region we can determine the value of any house.

Ask an Appraiser, (which, in California are tested and certified the Bureau of Certified Appraisers and are used by Banks, Credit Unions and mortgage companies) and they would generally agree that the CMA is a good starting point and a pretty good estimate, but they may also add to that the comparable sales information collected by the various title companies and other database companies such as Core logic that also collect that type of data on sales not found in the MLS.

I would argue that both definitions are somewhat flawed because none deal with the true value of a house.

Does the availability of Financing Change the Value of a House?

That is an important distinction, because the general public does not understand that in the real estate market, the availability financing, artificially changes the equation for the value of any house and because buyers can spread out their payments they are willing to pay more, over time.

You’re saying to yourself how can that be? How can the availability of financing really change the value of a house?

In fact I‘ll argue that financing artificially inflates the value of any house to sometime double and triple its current market value by the time that all payments are made and yet no one complains about that.

Let’s forget that we have any sales data for a minute, let’s forget that we can run a CMA and let’s forget that we see prices rising in a lot of real estate markets. It is important for you to clear the memory banks of how you arrive at value defined by your training and marketing absorption.

For those of you that remember the housing bubble 8 years ago, do you remember using 3 months of sales data that continued to climb insanely month after month until the bubble burst and the free fall of housing prices began? Do you remember when House values plummeted? What was the free fall tied to?

Did I hear anyone say financing?

Wait a minute, if financing were to disappear for the express purpose of purchasing a home what would you be left with?

Did someone say Cash Home Buyers?

Congratulations you get it.

Is it now fair to say that the value of a house is worth what someone is willing to PAY CASH for it?

Not convinced?

Well, actually it is… ask yourself absent any financing, how many buyers are you going to be walking through the homes that you have listed for sale?

It’s ironic that we have such poor memories and a lack of understanding of economics in this country. It’s a shame that as a profession, real estate agents and investors alike believe that a home’s value emanates from the sales price of another home stimulated by financing. It doesn’t.

The Value of any item is not tied to how similar items performed last month… that is speculation. The value of the home is based on what it cost to build (and sometimes less) and only what someone else is willing to PAY CASH for it.

The simple truth is that when you include financing into the equation the numbers change dramatically. Contrary to popular opinion, financing a house does not make it more affordable. The actual value of the house remained unchanged, but the price to purchase it increased in order to finance it over time thus generating huge profits for whoever holds the note.

So the next time a customer asks you what the value of their house is, think for a moment and recognize that there may be artificial factors that add value in the form of financing. Let’s not forget about supply and demand either, because both play a huge role in determining the value of any house regardless of its condition.

My hope is that the next time you review an all cash offer that is made by an investor, you don’t rush to judgement. All things are not equal including the condition of the house and the risk of loss to the buyer.

Now for the rest of the story: I purchased that house for the amount of my original offer. There were no inspections ordered, no contingencies, no appraisals and no banks. I used the same tools that everyone has available to determine the market value of that house in Sacramento its current As-Is condition and I bought it.

When the preliminary title report was released it was discovered that the house had $7,384.00 in past code violations/liens, a non-permitted garage conversion and two other unrelated lien items. I think that sometimes we forget who puts up the cash and who takes the risk when purchasing distressed properties, but one thing is for sure, I have never stolen a house.

What is My House Worth in Sacramento?

Finally, I tell all of my customers that “I will gladly pay what you want for your house, if you’ll agree to my terms.”

My Name is Peter Westbrook and I am a proud real Estate Investor located in Sacramento, Stockton, Manteca, Lodi, Galt, Tracy, and Modesto CA. We are experienced Cash home Buyers in Sacramento and We buy Houses and pay cash.

Call me at (209)481-7780 and let me make you a fair market value offer for your house in Sacramento.